- Startup Chai

- Posts

- Blue Tokai’s Bridge Round, Tesla Gets 600 Orders, and Ola Krutrim’s Lay Offs

Blue Tokai’s Bridge Round, Tesla Gets 600 Orders, and Ola Krutrim’s Lay Offs

Plus Flipkart’s Stake in Pinkvilla, and fundraising news about LeafyBus, Tuco Kids, and CityMall

Blue Tokai’s new fundraise smells like confidence and caution in the same cup. A $25 million bridge - underwritten by its existing backers A91 Partners, Anicut, Verlinvest and 12 Flags - keeps the roasters warm, the store rollouts on schedule, and the Dubai-Japan foray alive. It also says what Blue Tokai won’t: that fresh, outside capital at an upround is scarce, and India’s D2C story has shifted from froth to fundamentals.

The company’s bet is audacious. After growing revenue from ₹41 crore in FY21 to ₹216 crore in FY24 - while widening net losses 46% to ₹62.9 crore - Blue Tokai has doubled its ambition: 800+ cafés and ₹2,000 crore in revenue within four years, up from its earlier ₹1,000 crore and ₹100 crore EBITDA-by-2027 guide. That’s not just optimism; it’s a high-wire act in a market that now demands “unit economics first.” A bridge round buys 6-12 months of runway to prove those economics, often with tougher terms and the shadow of flat or down-round signaling if targets slip.

You can feel the ecosystem turning. This moment rhymes with India’s 2015-16 funding winter: capital has pulled back, the “growth at all costs” script is out, and domestic VCs and family offices are asserting themselves while late-stage tourists retreat. D2C remains big with 80-plus billion dollars of spend with 800+ active brands and a long runway to 2030, but the scoreboard has changed. Profit over GMV. Retention over paid reach. M&A over IPO heroics.

Coffee is a clean lens on that transition. Blue Tokai leads on total funding (about $106 million) and physical scale (150+ cafés), but the pack is crowded: Third Wave raised heavily, then cut staff and changed CEOs; Sleepy Owl and Rage run lighter. This clearly highlights that capital raises don’t brew loyalty, consistency does - and a café P&L that tolerates rent, staff, and waste only if average order value and repeat cohorts keep compounding.

That is why “phygital” isn’t buzzword here - it’s margin math. Owning the ritual (the café) and the relationship (direct digital) lowers blended CAC, deepens brand memory, and lets product and pricing travel across channels. Blue Tokai’s acquisition of Suchali’s Artisan Bakehouse is a quiet masterstroke: richer menus without bakery capex, higher tickets without discounting, and a café experience that sells a moment, not just a mug.

There’s a global compass, too. America’s third-wave darlings - Stumptown and Intelligentsia - eventually chose consolidation under Peet’s/JAB. Elsewhere, D2C mascots like Oatly and Allbirds learned the hard way that public markets won’t subsidize indefinite losses for brand love. India is not exempt. Today’s bridge is tomorrow’s fork in the road - either prove profits and price power, or accept that the cleanest liquidity may be a strategic sale to an FMCG or global beverage platform that can amortize your story across its shelves.

While the company is celebrating its new funding, customers are noticing some changes. People are complaining about fewer discounts, higher prices, and the quality of the coffee. Other brands, like Araku, are quickly becoming popular alternatives. For a D2C brand, building a close relationship with customers is key. If you lose their trust, the money you spend on ads just becomes a cost instead of a way to grow. This new funding must be used not just for new stores, but to regain customer confidence in the quality of the coffee, good service, and fair prices.

So what does Blue Tokai’s bridge really say about India’s D2C present? That premiumization is real, but not unconditional. That capital is available, but now asks adult questions. That scale must be earned in cafés and kitchens, not pitch decks. If Blue Tokai turns this bridge into a path - tightening unit economics, comping positive without subsidy, compounding café-plus-direct cohorts - it graduates from growth story to business. If not, consolidation will write the ending, as it often does in categories where brand is strong, but balance sheets stronger. Either way, the froth has settled. What’s left in the cup will finally be judged on taste.

Let’s go through what else is happening in Indian startup world - Grab your simmering cup of StartupChai.in and unwind with our hand-brewed memes.

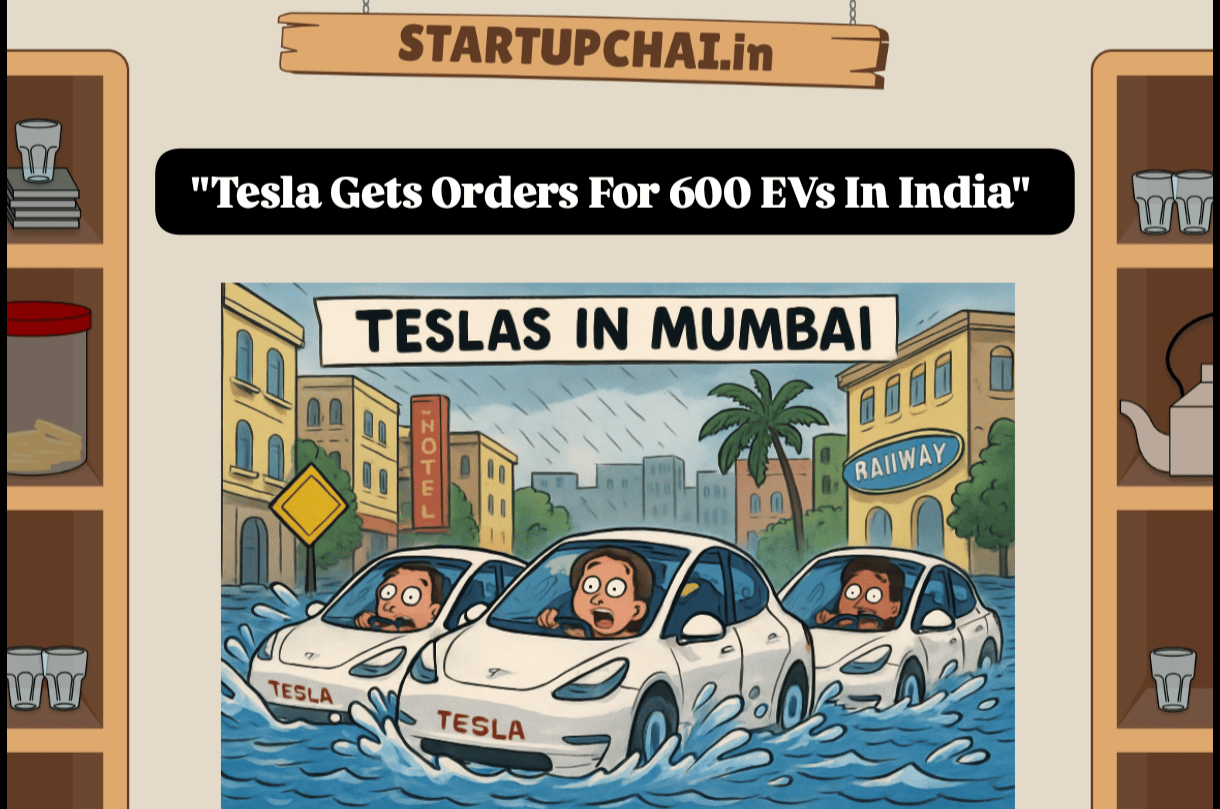

“Ab Aayega Maza”: Tesla Gets Orders For 600 EVs In India

Looks like Tesla’s India debut isn’t exactly making sparks fly, only 600 EVs have been ordered so far. The first batch of cars is expected to roll in this September, with 350-500 units on the road this year.

To keep things charged up, Tesla is also exploring supercharging stations across the country.

Read more here

“Apna Apna Dekh Lo”: Ola Krutrim Lays Off 50 Employees In Fresh Job Cuts

Ola Krutrim is trimming down again - this time letting go of 50 employees from its linguistics team. The cuts hit roles tied to regional languages like Bengali, Malayalam, and Punjabi, including team leads and transcribers.

This marks yet another round of layoffs since June, as the AI startup continues its restructuring drive.

Read more here

“Hum Saath Saath Hai”: Flipkart Acquires Majority Stake in Pinkvilla To Woo Gen Z Audiences

Flipkart just bought a majority stake in Pinkvilla, the celeb and entertainment news hub, for an undisclosed sum.

The move is all about winning over Gen Z by tapping into Pinkvilla’s strong content game. With movies and celebrity buzz shaping online trends, Flipkart sees this as the perfect hook for deeper audience engagement.

Read more here

“Sala Mai Toh Sahab Ban Gaya”: DriveU Cofounder Ashok Shastry Steps Down

DriveU cofounder Ashok Shastry has stepped away from his daily role citing “personal” reasons, though he’ll stay on the board.

His father, Ramprasad Shastry, has been steering the startup as CEO since 2022. Interestingly, the much-talked-about $10 Mn Series B raise Ashok hinted at last year never really took off.

Read more here

Venturi Partners has marked the first close of its second fund at $150 Mn, eyeing a final close of $225 Mn by June 2026. The fund will back 10 purpose-driven consumer brands across India and Southeast Asia with cheque sizes of $15-40 Mn.

Read more hereEV startup LeafyBus has raised $4.1 Mn to expand its fleet with 100 new electric buses over the next two years. Currently serving Delhi-Dehradun and Delhi-Agra routes, the company also plans to enter new cities with this push.

Read more hereD2C kids’ brand Tuco Kids has bagged $4 Mn in a round led by RTP Global, with participation from MG Investments, Whiteboard Capital, and Fireside Ventures. The startup will use the funds to boost brand building, distribution, and product innovation.

Read more hereOffgrid Energy Labs has raised $15 Mn to scale its patented ZincGel battery technology, with plans for a UK demo unit and a gigawatt-scale plant in India. The company aims to launch commercially by early next year, targeting global markets like Europe.

Read more hereCityMall has secured $47 Mn in fresh funding to expand its private labels, strengthen distribution, and build new brand partnerships. The Meesho rival, focused on Tier III and IV towns, has now raised a total of $165 Mn since its 2019 founding.

Read more here

How did today's serving of StartupChai fare on your taste buds? |