- Startup Chai

- Posts

- India’s EV Reset, Ola CEO Sells Shares, and Coinbase Investments

India’s EV Reset, Ola CEO Sells Shares, and Coinbase Investments

Plus Zuppa Partners with IISc Bengaluru, and fundraising news about WickedGud, Evoke, and SuperYou

Every EV founder in India used to believe the same myth: “Make it cheaper and India will buy it.”

But the data now proves the opposite. The sub-₹1 lakh EV scooter market is shrinking, even though new models are being launched almost every month. Meanwhile, the premium EV segment above ₹1 lakh has grown 50% YoY. A market that was supposed to explode at the bottom is actually exploding at the top. And no one expected this inversion to happen so quickly.

Ola Electric is the most dramatic example of this collapse. After pushing the “affordable EV” narrative harder than anyone else, Ola has watched its sales fall off a cliff. In September 2025, Ola sold just 13,374 units, a 46% YoY decline, and fell from India’s No. 1 EV brand to No. 5. By December, its monthly volume dropped to 2,833 scooters, a complete breakdown of a once-dominant playbook. Massive discounts, endless variants, and a price-first strategy couldn’t save it. Because the problem wasn’t price, it was positioning.

Indian consumers never saw EVs as a “cost-saving alternative.” They saw them as an upgrade. An EV is not like buying budget soap or a cheaper data plan. It’s a lifestyle upgrade, a tech upgrade, and most importantly, a reliability upgrade. You don’t replace your petrol scooter with a cheaper EV. You replace it with a better one.

And that’s exactly why Ather, TVS, and Bajaj are surging while cheap EV makers are collapsing.

Look at Ather. Instead of fighting in the budget war, Tarun Mehta openly refused to launch a sub-₹1 lakh model, calling it “a bloodbath with no reward.”

He was right.

Ather’s Rizta, priced above ₹1 lakh, is one of India’s fastest-scaling EVs ever: 1 lakh units in 13 months, 2 lakh units in just 6 months after that. Now, 70% of Ather’s total sales.

Even more interesting: 70% of Rizta customers were not Ather users before. They upgraded straight from their petrol Activas and Access 125s. They didn’t want “the cheapest EV.” They wanted the most trustworthy one.

TVS and Bajaj’s story is even more telling. Their EVs, priced at ₹1.40-1.60 lakh, now dominate India’s EV landscape. TVS iQube alone has sold 5.7 lakh units cumulatively.

In August 2025, TVS sold 24,087 scooters, capturing 23% market share, miles ahead of budget competitors.

Bajaj’s Chetak continues to hold 11% market share despite limited production due to rare-earth magnet shortages.

These are not “premium niches.” These are now the mass market winners.

Meanwhile, the sub-₹1 lakh segment is turning into a graveyard. Hero Electric, Ampere, Okinawa, Yulu, Komaki - dozens of models, dozens of launches - and yet the category keeps contracting. Why?

Because cheap EVs in India suffer from three fatal flaws:

A race to the bottom on quality: Indian suppliers optimise for “lowest price,” not highest reliability.

Trust erosion: Ola’s service bans (Goa in Dec 2025), rejected service requests, brake issues, loose panels - all of this killed consumer confidence in “affordable EVs.”

Cannibalisation instead of growth: When 20 brands fight under ₹1 lakh, they eat each other alive.

It’s not that sub-₹1 lakh EVs won’t exist - they will. But they will serve fleet buyers, gig workers, and hyper price-sensitive first-time customers. Retail buyers, who drive 80% of brand momentum, have moved upmarket for good.

India doesn’t want the cheapest EV anymore - it wants the one that won’t fail. Premium EVs aren’t a luxury segment; they’re the new mass market. The brands still chasing “budget” are already playing yesterday’s game.

Let’s go through what else is happening in Indian startup world - Grab your simmering cup of StartupChai.in and unwind with our hand-brewed memes.

“Humari Bhi Haan Haai”: CCI Clears Coinbase’s Investment In CoinDCX

The CCI has cleared Coinbase Global’s plan to pick up a minority stake in CoinDCX’s parent DCX Global, removing the last regulatory speed bump.

The approval follows Coinbase’s October investment at a $2.45 Bn post money valuation, aimed at scaling its presence in India and the Middle East. Founded in 2018 by Sumit Gupta and Neeraj Khandelwal, CoinDCX was India’s first crypto unicorn and remains one of the country’s largest exchanges.

Read more here

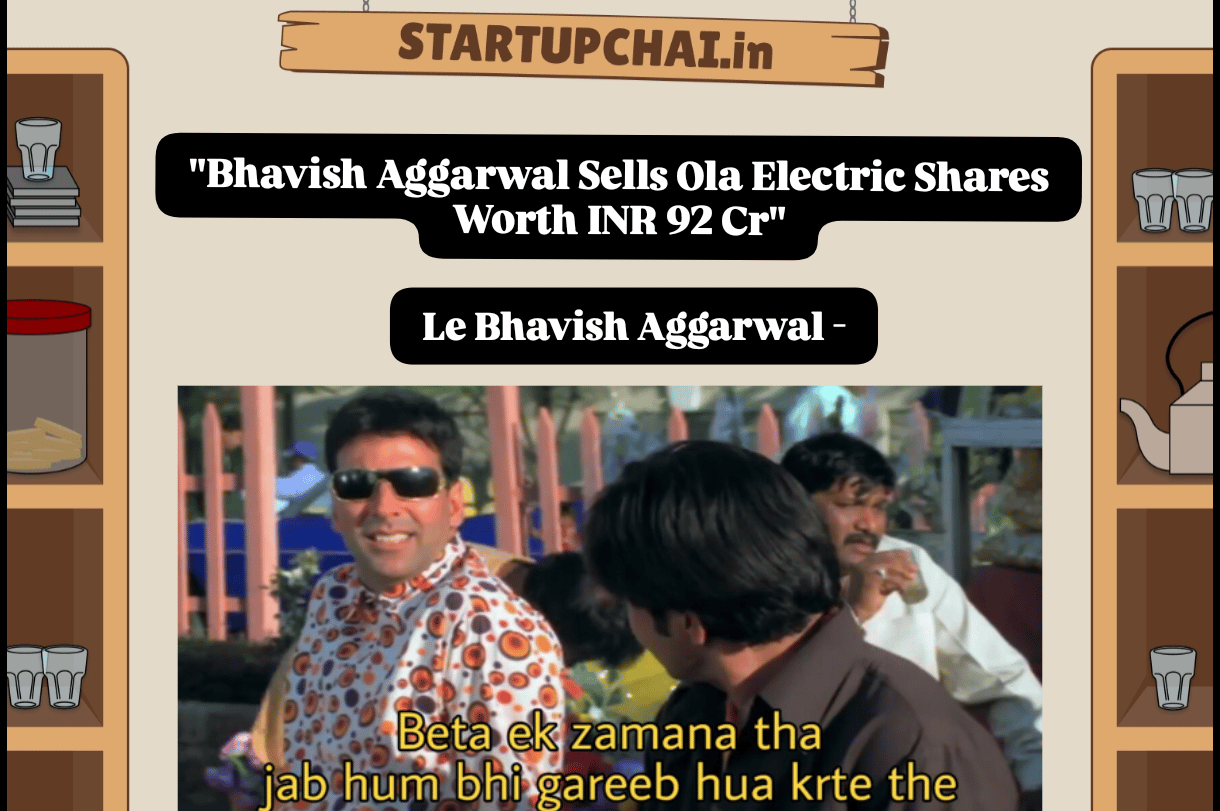

“Waah Kya Scene Hai”: Bhavish Aggarwal Sells Ola Electric Shares Worth INR 92 Cr

Ola Electric cofounder Bhavish Aggarwal has sold a 0.6% stake or 2.6 Cr shares in the EV maker for ₹92 Cr via a bulk deal, pricing each share at ₹34.99, slightly above the day’s closing price.

Before the sale, Aggarwal held a 30.02% stake, with a portion pledged to lenders and a large chunk locked in, according to BSE data. The company clarified that the transaction is part of a broader promoter-level move to fully release share pledges worth around ₹260 Cr.

Read more here

Zuppa Geo Navigation Technologies has teamed up with IISc Bengaluru to set up a drone center of excellence at the institute’s mechanical engineering department, signaling a push for homegrown UAV innovation.

The CoE will focus on research, design, and testing of autonomous drone systems, aerial platforms, and cyber-physical integration. The idea is simple and strategic: strengthen India’s domestic drone capabilities across defense, agriculture, logistics, disaster response, and smart cities.

Read more here

WickedGud has raised ₹20 Cr from existing investors Orios Venture Partners and Asiana Fund, along with new individual backers, to deepen its omnichannel presence. The F&B brand, which makes instant noodles and pasta, plans to use the capital to expand distribution and roll out new product formats.

Read more here

Hair care startup Evoke is in advanced talks to raise $3 Mn to $4 Mn in a Series A round led by 3one4 Capital, with participation from existing backer Info Edge Ventures. The fresh capital will be used to open more hair clinics across Delhi NCR and fuel expansion into new cities.

Read more here

D2C protein brand SuperYou has raised ₹63 Cr or $7 Mn in a Series B round led by V3 Ventures, with participation from Rainmatter and Gruhas Collective Consumer Fund. The startup will deploy the capital towards R&D, strengthening distribution, and expanding its team.

Read more here

MoEngage has raised an additional $180 Mn, taking its Series F round to a hefty $280 Mn after a $100 Mn raise in November 2025. Led by ChrysCapital and Dragon Funds with support from Schroders Capital and existing backers, the capital will fuel its Merlin AI suite, global go to market push, and strategic acquisitions.

Read more here

Decode Age has raised ₹14.48 Cr in a pre Series A round led by Granules India CMD Dr Krishna Prasad Chigurupati to push deeper into longevity and microbiome science. The capital will help the startup sharpen its mission of making ageing biology measurable and actionable through science led solutions.

Read more here

How did today's serving of StartupChai fare on your taste buds? |