- Startup Chai

- Posts

- (The Weekend Insight) - The Silent Builders: How Ghost SaaS Startups Are Thriving in India

(The Weekend Insight) - The Silent Builders: How Ghost SaaS Startups Are Thriving in India

They skip the spotlight, but build global, profitable SaaS from the shadows. India’s quiet tech revolution is here.

On today’s deep-dive, we will explore the quiet but powerful rise of ghost SaaS startups in India - lean, bootstrapped, and often invisible ventures that are quietly building global software businesses without funding announcements, pitch decks, or press coverage.

They don’t do funding announcements. They don’t speak at conferences. And they almost never tweet about their ARR. Yet, they’re building some of the most efficient software businesses in India today.

Welcome to the world of ghost SaaS startups - a growing breed of Indian founders who operate in near invisibility, building profitable, global-facing software products with little to no online presence.

The trend didn’t start overnight. It slowly gained momentum as Indian developers, indie makers, and former startup employees started solving niche problems for global markets. With better access to low-code tools, API infrastructure, and platforms like Stripe, the barrier to launching a SaaS product from your bedroom has collapsed. And Indian builders fluent in frugality, tech, and hustle - are taking advantage of that.

Take the example of Superlemon, founded by Rajat Jain and Preetam Nath. It began as a simple WhatsApp plugin for Shopify sellers. The duo bootstrapped the entire thing, acquired thousands of merchants, and eventually sold the product to DelightChat - another Shopify-focused SaaS startup. For a long time, Superlemon ran with minimal staff, no office, and no PR. It was a ghost success story - profitable and invisible.

Or consider InVideo, co-founded by Sanket Shah, which began as a quiet, bootstrap-first video creation tool for marketers and SMBs. Without chasing hype or heavy VC rounds initially, the team focused on product-led growth and community, onboarding global users via SEO and content strategies. Only after validating product-market fit and hitting scale did they raise funding. InVideo quietly crossed 7 million users across 195 countries.

Mailmodo, founded by Aquibur Rahman, began with a similar approach. While it’s now a well-known player in the email marketing space, its early days were quiet. The team focused entirely on building a robust AMP email platform for marketers, acquiring early users through cold outreach and product-led growth, not buzz.

Even the startup TrueFan, founded by Raghav Bagai, followed this path to an extent. The team focused on quietly building a product that allowed fans to engage with celebrities via personalized video messages. They avoided the spotlight initially, refined the product, and then raised money from Elevation Capital.

These ghost SaaS startups share a few things in common:

They are extremely lean.

They solve narrow but painful problems.

They grow through SEO, communities, and word of mouth.

They avoid burn and often reach profitability fast.

Globally, the SaaS market is expected to touch $908 billion by 2030. Even if Indian ghost SaaS captures a sliver of this, the scale is huge. India already accounts for over 8% of SaaS unicorns globally and boasts more than 2,000 funded SaaS startups. But beneath that visible layer lies an army of micro, bootstrapped, and ghost startups operating at impressive profitability.

Unlike the traditional venture-backed startup playbook - raise funds, announce launch, chase blitz-scaling - these founders do the opposite. They stay anonymous, work quietly, and only go public when absolutely necessary (like after an acquisition or funding round).

One reason this model is picking up steam in India is the sheer rise in developer talent and indie maker communities. Platforms like Product Hunt, IndieHackers, Gumroad, and Twitter have created global distribution channels for Indian makers. A solo developer in Indore can now sell a Chrome extension to users in California, charge in USD, and run a $10K/month SaaS - without ever forming a company in India or hiring a team.

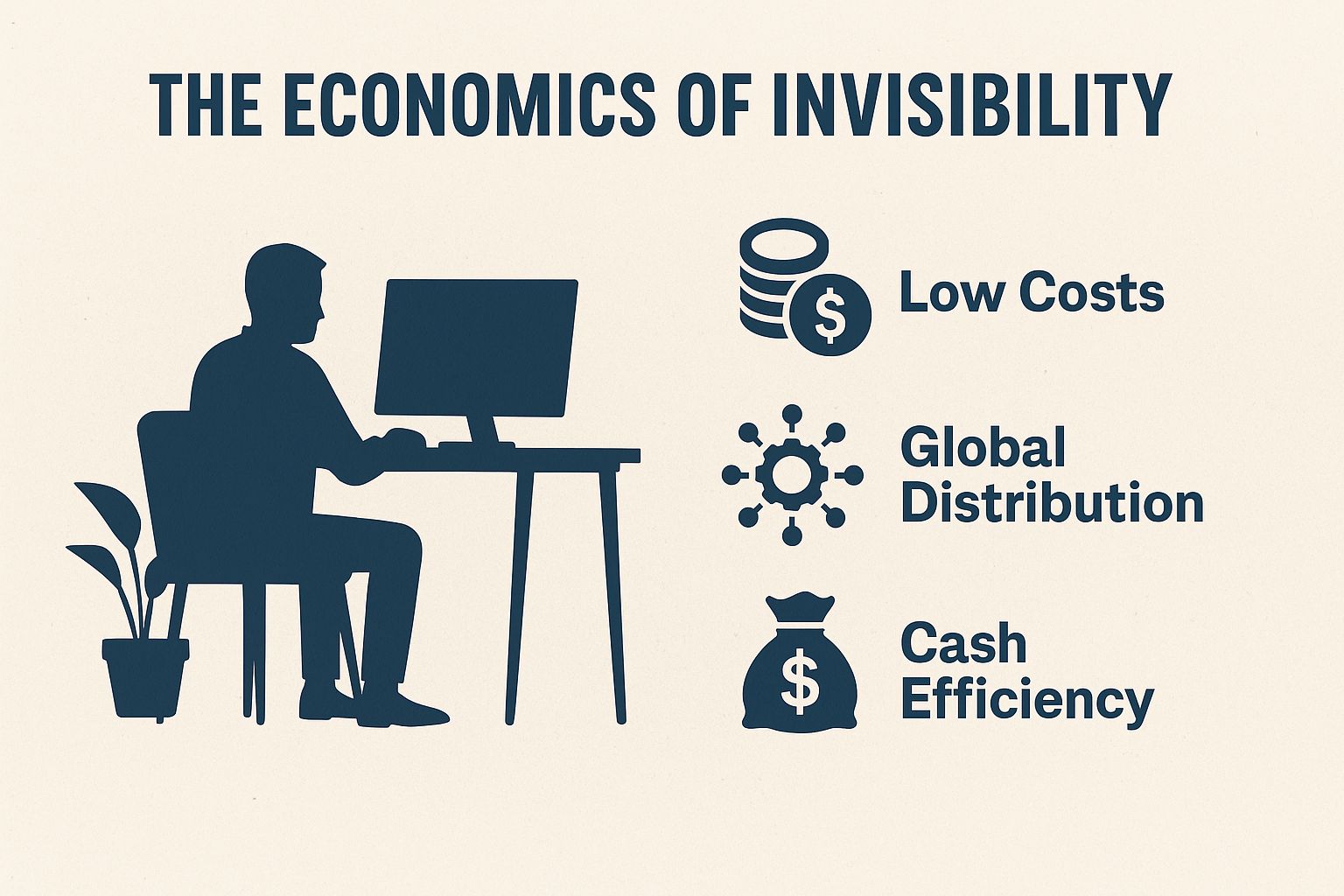

The economics of invisibility works in their favor. These founders avoid CAC (Customer Acquisition Cost) traps, don’t hire sales teams, and use platforms like Stripe, Paddle, or Lemon Squeezy to handle payments. They rely on organic growth, content, and community channels. With monthly expenses under $1,000 and revenue upwards of $8,000–10,000/month, their margins are enviable.

Their tech stack is equally frugal and effective. Most ghost SaaS builders use:

Firebase or Supabase for backend

Vercel or Netlify for deployment

Notion, Trello, or Linear for task tracking

GitHub + Slack or Discord for async collaboration

Zapier or Make.com for automation

Figma for design

Many don’t even write code from scratch anymore. They stitch together APIs or use tools like Retool, Webflow, or Bubble. Some are experimenting with GPT-4 and LLMs to add intelligence to niche workflows.

Some founders are turning this model into a repeatable framework. Many of them build products for niche user groups - designers, writers, developers, fitness trainers - and monetize early with freemium models, lifetime deals on AppSumo, or micro-subscription plans ($4/month to $29/month).

Others go one step further and build SaaS apps that serve other SaaS builders, such as tools for managing newsletters, no-code integrations, AI prompts, browser extensions, and more.

There’s also a growing group of Indian ghost SaaS founders who are going cross-border. They register companies in Dubai or Singapore to ease compliance, use Stripe Atlas to set up bank accounts, and handle support asynchronously with contractors from around the world. It’s a one-person multinational company with no office, no employees, and no fame.

India's developer ecosystem is a huge advantage. With over 5.2 million developers, India ranks second only to the US. Add to that a culture of Jugaad, strong English proficiency, and increasing access to global platforms, and you have fertile ground for ghost startups.

The playbook is not new. Makers like Sankalp Jonna, co-founder of Superlemon and DelightChat, have been vocal about how Indian builders are uniquely positioned to dominate this game. They understand constraints, they move fast, and they don’t over-engineer.

Yet, this rise of ghost SaaS raises a few important questions:

What happens when such startups scale?

Do they remain invisible, or do they eventually enter the mainstream?

Should Indian VCs care about this movement?

Many investors already are. Some funds are now creating scout programs and angel syndicates focused on backing indie SaaS founders early - often with cheques as small as $25K. The idea is to get in early, let the founder run the product their way, and see if there’s potential for scale later.

But this also creates a tension: ghost SaaS founders are often allergic to the standard VC model. They value freedom, hate meetings, and prefer async growth over hockey-stick ambition. This makes them hard to invest in, and harder to control.

Still, this model has undeniable advantages:

Time zone arbitrage

Low cost of living

Global market access

Strong engineering talent

Deep niche knowledge

A quiet but growing number of bootstrapped SaaS products in India are hitting $100K+ ARR within 12-18 months. A few even cross $1M ARR with zero full-time staff.

India may not have birthed this movement, but it might scale it like no other country can. As regulatory clarity improves, and as more tools become globally accessible, Indian ghost SaaS might evolve into a mainstream category of its own - one that doesn’t follow the Silicon Valley playbook, but writes its own.

Because behind every ghost SaaS product, there’s a founder quietly solving a problem - often from a 1BHK flat, running support via Loom videos, and shipping updates while sipping chai. And while they may not trend on LinkedIn, they’re building something far more valuable: profitable, sustainable businesses.

How did today's serving of StartupChai fare on your taste buds? |